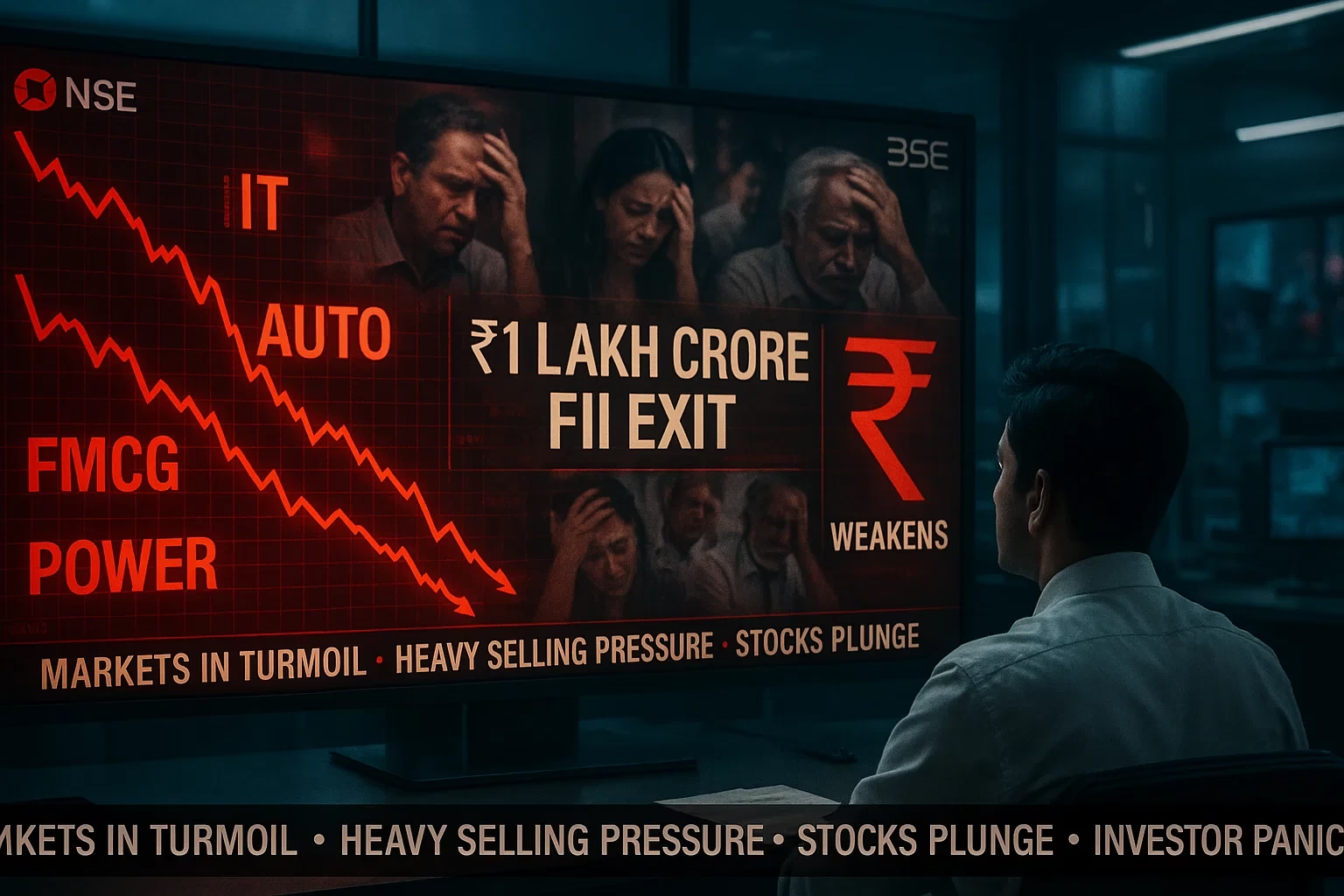

Foreign Institutional Investors (FIIs) have pulled out a staggering ₹1 lakh crore from six major Indian sectors over the last six months, triggering volatility and prompting investors to rethink portfolio strategies. The outflow, amounting to approximately $12 billion USD, has sent tremors across India’s stock markets, especially in traditionally strong verticals like Information Technology (IT), FMCG, Automobile, Consumer Services, Power, and Consumer Durables.

This massive sell-off is being attributed to a combination of high sector valuations, tightening global liquidity, and uncertainty in international demand—especially from recession-sensitive markets like the U.S. and Europe.

Sector-Wise Breakdown: IT Sector Bleeds the Most

According to data from The Economic Times, the IT sector alone witnessed outflows worth ₹33,479 crore, making it the worst-hit segment. This marks a significant reversal from pandemic-era optimism when tech stocks were the top picks for foreign investors.

Other key sectors also took heavy hits:

-

FMCG: ₹17,200 crore withdrawn

-

Automobile: ₹14,800 crore outflow

-

Consumer Services: ₹13,500 crore outflow

-

Power: ₹11,300 crore outflow

-

Consumer Durables: ₹9,800 crore outflow

These sectors, often considered high-growth and low-risk in normal market cycles, are now facing the brunt of valuation fatigue and changing global capital flows.

Where’s the Money Going?

Interestingly, while several core sectors faced sell-offs, certain domestic-oriented sectors bucked the trend. FIIs have pumped in:

-

₹23,065 crore into Telecom

-

₹9,456 crore into Financials (mainly banking and insurance)

This shift suggests a strategic reallocation by FIIs toward India’s consumption-driven, regulated sectors, which are expected to stay relatively insulated from global demand shocks.

A recent HSBC Q4 review supports this sentiment, stating that “global demand moderation is evident, particularly in consumer staples and tech services. Domestic-focused sectors offer more stability in the near term.”

Currency at Risk: Rupee May Face More Pressure

Historically, large-scale FII outflows have correlated with depreciation in the Indian rupee. A 2024 report by ICICIdirect noted that when FII net selling crosses ₹75,000 crore in any half-yearly cycle, the rupee tends to weaken by 2–3% due to reduced liquidity and increasing import bills.

Already under pressure from rising crude prices and potential interest rate changes abroad, the INR could breach the ₹85/$ mark if these outflows continue. This would worsen inflation, especially for fuel and imported goods, impacting both businesses and consumers.

Domestic Investors Step In — But Can They Plug the Gap?

While Domestic Institutional Investors (DIIs) and retail investors have shown resilience by absorbing some of the sell-off pressure, analysts say they may not fully offset the depth and scale of foreign exits.

According to SEBI data, DIIs have invested close to ₹72,000 crore in the same period—mostly in public sector banks, infrastructure, and mid-cap stocks. However, the disparity in capital strength between FIIs and domestic investors remains stark.

What’s Driving This Sentiment Shift?

-

Global Interest Rate Trends: With the U.S. Fed keeping interest rates elevated and bond yields attractive, FIIs are redirecting capital away from emerging markets.

-

China’s Rebound Uncertainty: Despite easing restrictions, China’s patchy economic data has made global fund managers wary, leading to a more cautious approach in Asia.

-

Indian Valuations: Nifty sectoral indices like IT and FMCG are trading at 20–25 times forward earnings—levels that many FIIs now deem unsustainable without earnings upgrades.

What It Means for Indian Investors

-

Short-Term Caution: Volatility in tech, FMCG, and auto stocks is expected to persist over the next quarter.

-

Sector Rotation Opportunity: Domestic investors may find value in sectors gaining FII interest—like telecom and financials.

-

Currency Hedging: Exporters might benefit from a weaker rupee, but import-reliant industries will need to rework cost structures.

Conclusion: A Wake-Up Call, Not a Collapse

This ₹1 lakh crore FII sell-off is not a vote of no-confidence in India’s long-term story, but a strategic rebalancing amid global uncertainty. As earnings season approaches and macroeconomic indicators evolve, investor sentiment may shift again.

For now, staying diversified, avoiding overexposure to overheated sectors, and monitoring global cues are the keys for both institutional and retail investors.