Stock Market Latest Updates | June 13, 2025

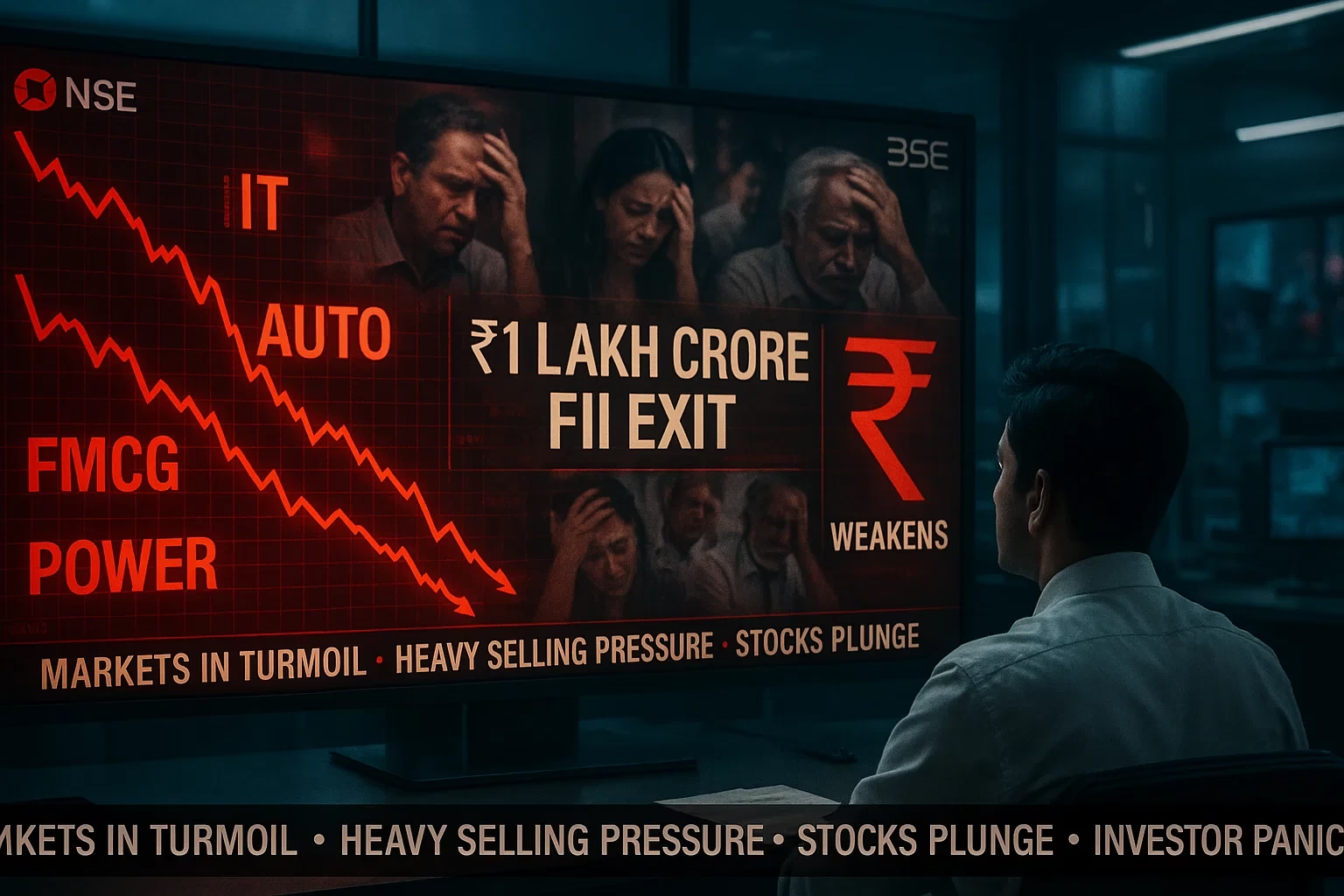

India’s stock markets ended lower today after a weak start, following negative global signals and rising crude oil prices. The BSE Sensex fell 573 points, closing at 81,118.6, while the NSE Nifty 50 dropped by 169 points to settle at 24,718.6.

Here’s a simple and clear summary of today’s stock market movement:

📌 Top Reasons Behind Market Fall Today:

-

Global Tensions Weighing on Market Sentiment:

Geopolitical tensions between Israel and Iran increased risk fears among investors, leading to negative sentiment worldwide. -

Brent Crude Oil Prices Rise:

Crude oil prices jumped to $76 per barrel, the highest this year, on fears of supply disruptions due to the Middle East conflict. -

Weak Cues from Global Markets:

Asian markets like Nikkei and KOSPI also traded in deep red, down more than 1% today, impacting Indian equities. -

CPI Inflation Data Eases:

On a positive note, India’s CPI inflation eased below the RBI’s comfort zone. This was expected to support market mood, but global worries overshadowed this good news.

📌 Sensex and Nifty Performance:

-

Sensex closed at 81,118.6, down 573 pts (0.7%)

-

Nifty50 closed at 24,718.6, down 169.6 pts (0.68%)

📌 Sector-wise Performance:

-

FMCG and Banking sectors were the worst hit.

-

Most other sectors also ended in the red.

-

Selective buying seen in heavyweight stocks limited losses.

📌 Top Gainers & Losers Today:

🔻 Top Losers on Sensex:

-

Adani Ports

-

ITC

-

IndusInd Bank

🔺 Few Gainers Helped Trim Losses:

-

Specific names not highlighted but selective buying was noticed.

📌 Midcap & Smallcap Indices:

-

Both BSE Midcap and Smallcap indices closed lower by nearly 0.5%.

-

Broader market sentiment remained weak.

📌 Expert Views on the Market:

✔️ Ajit Mishra, SVP, Religare Broking Ltd says:

“Traders should keep a balanced approach. Maintain positions on both sides with proper stock selection. Avoid aggressive trades until market stability improves.”

✔️ Vinod Nair, Head of Research, Geojit Investments adds:

“Geopolitical risks and rising oil prices are the main worries. Though inflation data is good for India, foreign institutional investors are cautious due to global uncertainty.”

📌 Important Updates for Next Week:

-

25 Companies to Go Ex-Dividend:

Major names like Bajaj Auto, Tata Technologies, and Honeywell Automation will trade ex-dividend. -

6 IPOs & 5 New Listings to Watch:

Including Arisinfra Solutions IPO and 5 SME IPOs launching next week.

📌 What Should Investors Do Now?

✅ Avoid aggressive positions.

✅ Focus on fundamentally strong stocks.

✅ Be ready for volatility until global tensions ease.

✅ Stay informed about crude oil price trends.